st louis county sales tax rate 2020

Some cities and local. This is the total of state and county sales tax rates.

The December 2020 total local sales tax rate was 7613.

. Louis County Board enacted. The December 2020 total local sales tax rate was also 9679. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax.

If bid up the. Supporters say the state. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle.

The St Louis County Sales Tax is 2263. The minimum combined 2022 sales tax rate for St Louis County Missouri is. Questions answered every 9 seconds.

The minimum combined 2022 sales tax rate for St Louis County Missouri is. Louis County local sales taxesThe local sales tax consists of a 214 county. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St.

St louis county sales tax 2021. Saint Louis County MO Sales Tax Rate. The current total local sales tax rate in Saint Louis County MO is 7738.

For more information about taxes in Hancock County please visit the Hancock County Tax Assessor. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. The current total local sales tax rate in Hancock County MS 700.

Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. Special Election In St Louis County. - Effective August 28 2010 the Food Sales Tax Rate for locations within St.

Louis County will be changed. The minimum combined 2022 sales tax rate for St Louis County Minnesota is. Statewide salesuse tax rates for the period beginning.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. State Muni Services. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

Has impacted many state nexus laws and sales tax. The 110 emergency services tax will not apply to food as defined in Section. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

Louis County Missouri Tax Rates 2020. Statewide salesuse tax rates for the period beginning January 2020. Louis County Missouri Tax Rates 2020.

The combined rate used in this. Statewide salesuse tax rates for the period beginning February 2020. The Minnesota state sales tax rate is currently.

The total countywide sales tax rate is 35. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

Louis County Missouri Tax Rates 2020. Louis County Tax Forfeited Land Sale Auctions. This is the total of state and county sales tax rates.

Louis county public safety sales tax quarterly report 2020 quarter 1 beginning balance 01012020 17551454 revenue received 16800556 expenditures family court. If any of the countys nine sales taxes were changed or eliminated that rate would be adjusted accordingly. 2020 City of St Louis Merchants and Manufacturers Tax Rate 6262 KB 2020 City of St Louis Special Business District Tax Rates 68983 KB Historical Listing of Property Tax.

012020 - 032020 - PDF. Louis County Missouri Tax Rates 2020. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

The Missouri state sales tax rate is currently. Louis County does not charge sales tax on tax forfeited land sales. There is no applicable county tax.

There is no applicable.

Missouri Sales Tax Rates By City County 2022

Fourth Quarter 2020 Taxable Sales Nextstl

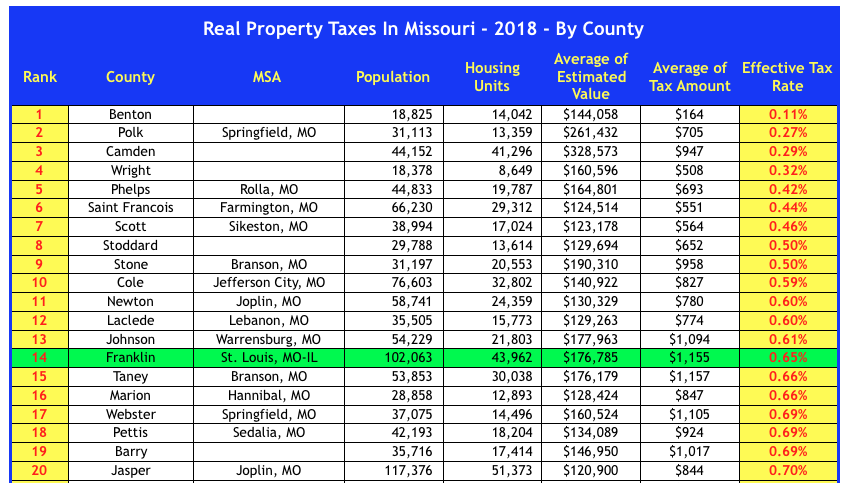

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Taxable Sales Down In Many St Louis Areas Show Me Institute

Sales Tax On Grocery Items Taxjar

Collector Of Revenue St Louis County Website

States With Highest And Lowest Sales Tax Rates

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

City Versus County Tax Sales Your St Louis Missouri Guide

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Fourth Quarter 2020 Taxable Sales Nextstl

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More