straight life policy formula

Calculate your annual straight life pension using your pension formula. Only upon the death of the second.

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

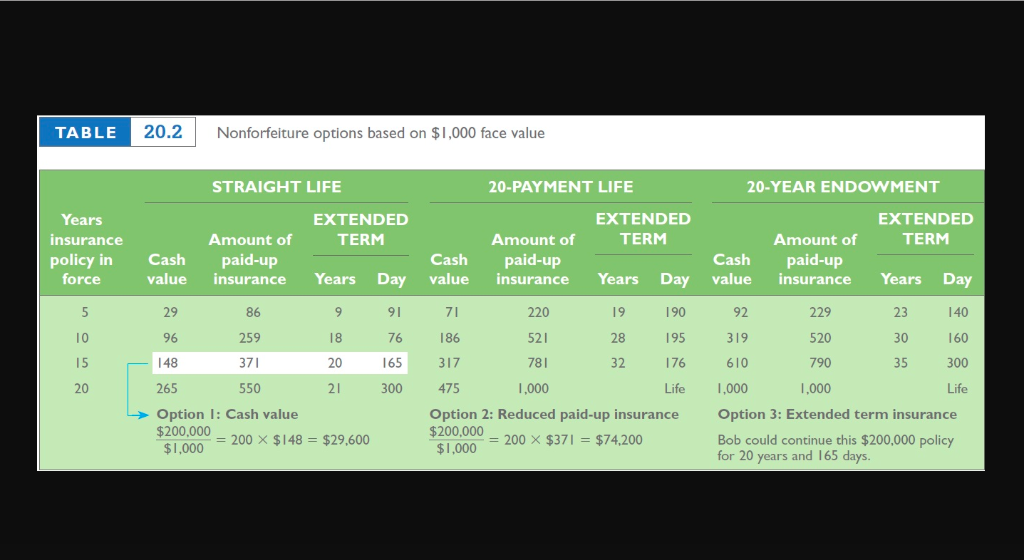

How Cash Value Builds In A Life Insurance Policy

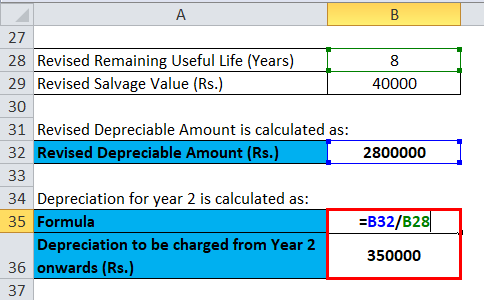

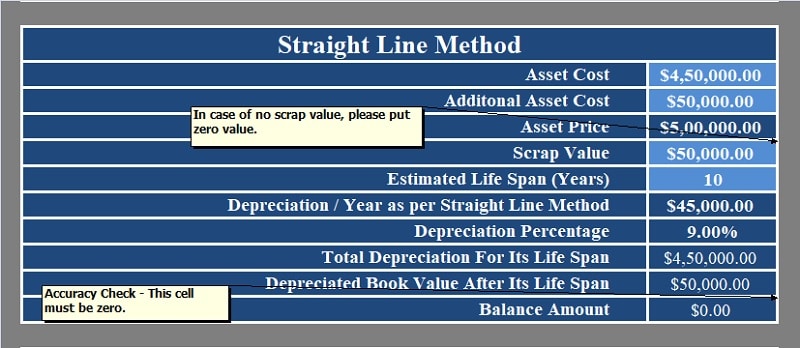

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable.

. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy. Determine the cost of the asset. Straight life is the simplest benefit option offered by APERS.

Straight life insurance is. Rate of depreciation. A first-to-die joint life policy pays when the first person dies.

A straight life insurance policy can also build cash. How to calculate the depreciation expense for year one. A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income.

Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the. You can also talk to a Sun Life advisor. Depreciation is calculated based on the fiscal years remaining.

The straight line calculation steps are. If you select Fiscal in the Depreciation year field the straight line service life depreciation is used. You then find the year-one.

The straight life option pays a monthly annuity directly to the retiree for life. On the death of the retiree the monthly payments. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used.

Joint life policies insure the lives of two or more people. Melissa Toby age 36 bought a straight-life insurance policy for 80000. Visit to learn more about uniform and non-uniform.

A survivorship life policy pays-. Straight Line Depreciation Formula Guide To Calculate Depreciation It is the most simple kind of one-dimensional motion. This is expected to have 5 useful life years.

In year one you multiply the cost or beginning book value by 50. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Divide the product by 12 to calculate your monthly straight life benefit.

A straight life annuity is tax-advantaged just as other annuities. A straight life insurance policy often known as whole life insurance. Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful.

Every calculation for other payment options. Straight life policy calculator Tuesday May 17 2022 Edit A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of. It is calculated based on the fiscal year which is defined by the fiscal.

The DDB rate of depreciation is twice the straight-line method. Rate of depreciation is the percentage of useful life that is consumed in a single accounting period. Rate of depreciation can be calculated as follows.

Fidelity Life Insurance Review 2022 Nerdwallet

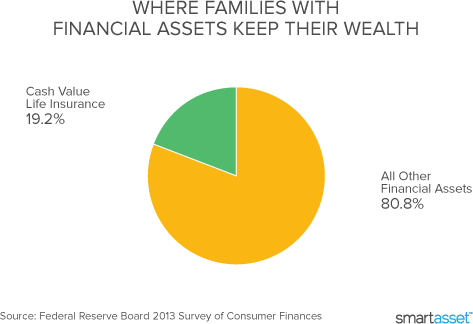

What Is Cash Value Life Insurance Smartasset Com

1 Free Straight Line Depreciation Calculator Embroker

How To Calculate The Amount Of Life Insurance You Need

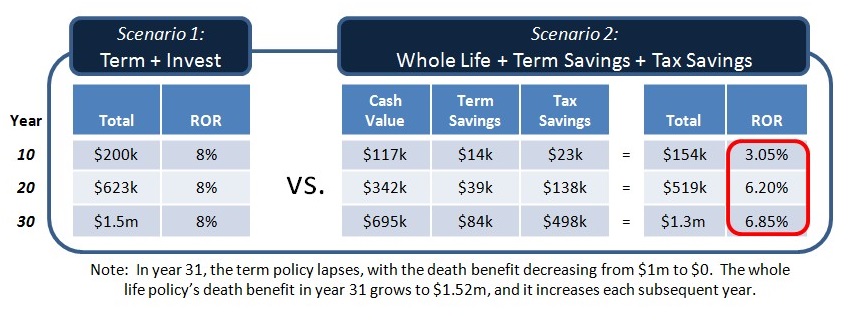

The Whole Story The True Rate Of Return Of Permanent Life Insurance Ultimate Estate Planner

Straight Line Depreciation Formula Calculator Excel Template

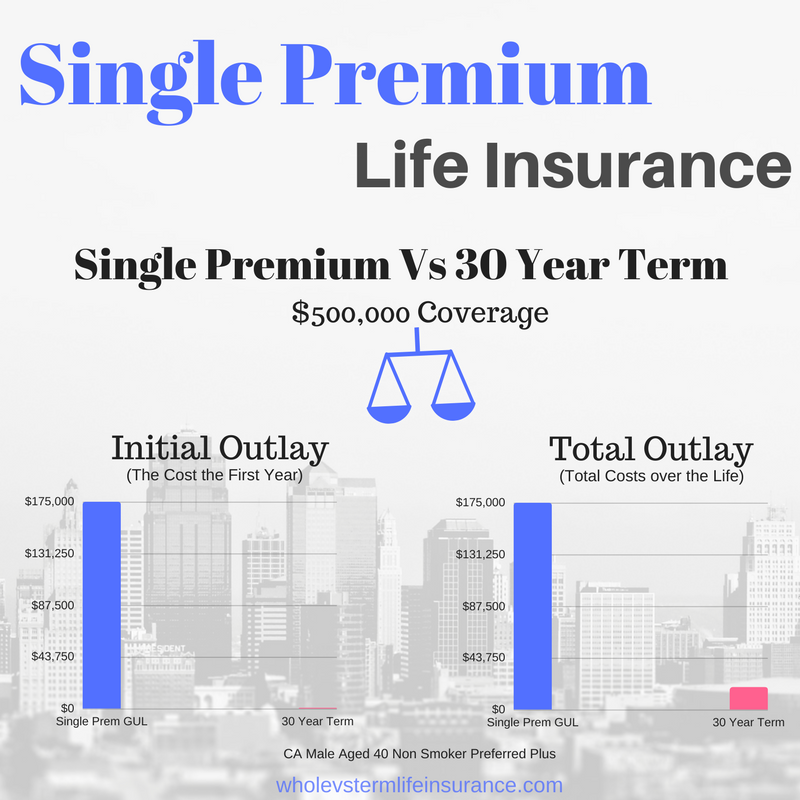

Single Premium Life Insurance Whole Vs Term Life

Depreciation Methods Principlesofaccounting Com

1 Free Straight Line Depreciation Calculator Embroker

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Emerging Trends In Claims Transformation Deloitte Insights

Download Depreciation Calculator Excel Template Exceldatapro

The Complete Resource For Straight Whole Life Insurance

Straight Line Depreciation Formula Guide To Calculate Depreciation

How To Calculate Premiums On A Whole Life Policy

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

What Is A Straight Life Policy Bankrate

Is A Straight Life Policy Right For Me Paradigmlife Net Blog